Daimler CEO secretly met with CEOs of Volkswagen and BMW to cooperate, after coming to the conclusion that it is very hard for them to develop the software for their cars on their own. Volkswagen is likely to cooperate after massive software problems. Progress on self driving features is also lacking. Its not a single problem, it is a deep cultural problem of German car manufacturers.

Volkswagen

Volkswagen should welcome a cooperation, considering its current disaster with the electric ID3 model. After the official production launch in November 2019 and announced start of deliveries in Summer 2020, its software is not finished yet. As thousands of cars are stored on vacant parking lots and the not yet opened new Berlin airport, some insiders are talking about possible delays up to twelve months. The basic structure of the software was developed ‘too hasty’ and is said to be ‘shaky’. To solve this problem VW has daily meetings with up to 100 software developers which are also attended by top-level management including the CEO. As over-the-air updates are not possible for these cars yet, 400 to 500 of them are supposed to be updated manually per day once the basic software with update functionality is done. VW considers to deliver the cars and add some features via updates at a later time. The company has not much time to wait for the software, as one production line with a capacity of 300 000 cars per year was set up in Zwickau, Germany with a planned production for 100 000 cars in 2020. A second one with the same capacity is planned to start production in Shanghai this year.

Volkswagen CEO Herbert Diess recognizes the challenge ahead. After starting a new software subsidiary called ‘Car.Software.org’, which aims to employ 10 000 by 2025, Diess said VW needs to become a tech company.

‘Honesty also means that the storm is only just beginning.’

– VW CEO Herbert Diess

He made an analogy to Nokia, which ignored trends in the smartphone market for too long. The CEO sees the most pressing issues on software the driver assist systems. Comparing to Tesla, he said ‘What worries me most are the capabilities of the assistance systems’. If VW would stay the same, the race against Tesla and other US tech companies for the supremacy in the car industry would be ‘very tough’.

Daimler starts secret CEO level meetings

Apparently Daimler is also facing troubles in software development. Major German newspaper Süddeutsche Zeitung reports Daimler seeks to cooperate on software with its German peers. They secretly met in one-on-one meetings with VW and BMW, not telling either of them about the talks with the other. They want to develop the operating system of the car together. All three of them cannot work on the same system, because that would lead to antitrust law issues, meaning one of the three has to loose out on the cooperation. That makes the secret one-on-one talks of the Daimler CEO look like betrayal.

Lack of Software Developers

The cooperation on car software aims to speed up development, as German car companies are lacking software developers. They are not seen as a top company to work for in the field, unlike Google or Apple. They are also lacking in software expertise on the management level, with almost all of the board of management of BMW, Daimler and VW being comprised of mechanical engineers and MBAs. Even electrical engineers are rare. Compare that to Tesla, where the CEO started internet companies beginning in 1995, including Paypal, and where the co-founder and CTO until 2019 was an electrical engineer. Tesla even has a vice president of AI.

Self Driving Tech

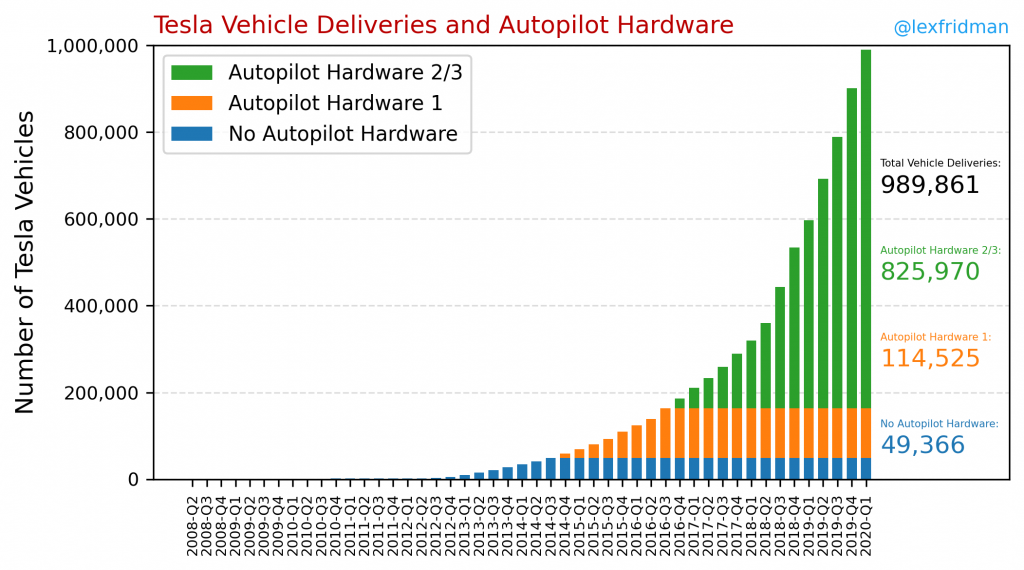

As mentioned Tesla’s Autopilot development infrastructure is giving Diess headaches. Tesla can collect real world data for specific problems from their fleet of almost one million cars with the newest cameras on demand. Say Tesla wants to improve the detection of a specific sign. They develop a trigger for that sign, which sends data to their servers if the car is unsure about the existence of the sign. Tesla then labels these examples to tell the Neural Net where it was right or wrong and adds them to the ever growing data set. Such an architecture is not easily replicable by conventional automakers, because their cars are very modular, with each component being developed and produced by a different supplier.

Conventional auto makers are not able to keep up with other self driving startups like Waymo, even though these do not produce their own cars, which puts them already on a disadvantage to Tesla. This is easily seen by looking at Californias public self driving data from 2018. Waymo only has one disengagement per 11000 miles driven, Cruise (which was bought by GM) one every 5200 miles. Startups like Zoox, Nuro or Pony.AI reach between one and two thousand miles. Nissan is the best conventional automaker except GM’s Cruise with 210 miles. BMW managed to achieve only 4.6 miles, and Daimler even less with 1.5.

Reasons

Now the Question is ‘Why are they lacking so much on the software side?’. Reasons are culture and lack of vertical integration. Unfitting culture can be explained historically. The heart of the German (and other countries) car industry is the combustion engine, the Diesel engine and high quality engineering. These are tasks for mechanical and sometimes electrical engineers, which means their workers and management from mid to top level is comprised of these mechanical and electrical engineers. As we see software getting ever important for cars, the appreciation is lacking. Software has to be on the mind at the earliest stages of car development, it can no longer be an add-on or simple part that is being bought from a supplier, because the components become more and more integrated and need to be updated over the internet. For bigger goals like development of self driving, this becomes even more apparent.

This leads us directly to the second reason, lack of vertical integration. As innovation in the car industry slowed down during the last century it made sense to modularize cars and buy cheaper from specialized suppliers. This is suddenly changing. With significantly improving computer chips, batteries and the advent of the internet, car companies need to become more vertically integrated again. With new technologies like electric and self driving cars, innovation is the most important strategy again, not cost savings. Having a very modular approach is slowing innovation, as every interface needs to be defined in long meetings with suppliers. This past approach also leads to a big shortage in in-house expertise in software. Up until now, software was more seen as a byproduct that can be contracted. This is inefficient and makes cooperation between sub-product teams hard. It also makes it hard to innovate, as there are too many stakeholders. Furthermore, it keeps the software competency outside the company.